Parts + Support

Financial Services.

NFI Financial Solutions™

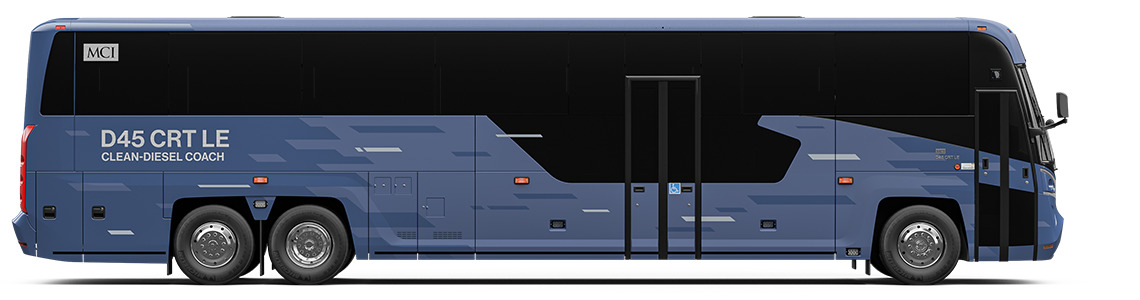

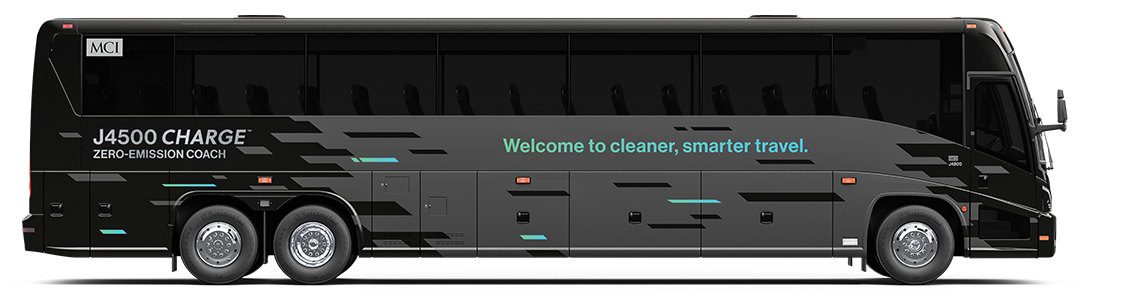

NFI Financial Solutions can help you find financing options to fit your needs for both clean-diesel and zero-emission buses and coaches. Our professionals understand your business and will work closely with you and your sales representative to customize a financing solution to meet your needs.

Programs that fit your financial goals.

NFI Financial Solutions has long-standing relationships with a wide range of financing sources. Tell us about your needs and your financial situation, and we will find the financial product that is the best fit for you.

We offer a variety of financial solutions including:

- Fixed rate loans

- Floating rate loans

- TRAC leases

- Special payment structures such as seasonal, step-up, or step-down payments

What can the financing cover?

- New and pre-owned buses and coaches

- Infrastructure development including planning, design, equipment and installation of a turnkey infrastructure solution

- Batteries

Financing options

- Tax-exempt Lease Purchase (TELP)

- Fixed or floating rate loans

- TRAC (Terminal Rental Adjustment Clause) Lease

- Operating lease

- Special payment structures such as seasonal, step-up, or step-down payments

Tax-exempt Lease Purchase (TELP)

TELPs are structured as a tax-exempt, municipal

leases with the title to the vehicle passing to Lessee. TELP’s are net leases under which, all costs, including insurance, maintenance and taxes, are paid by the Lessee for the term of the lease:

- Preserves of capital dollars

- Normally does not create long-term debt for the

lessee

- Enables improvement of cash flow

- Incorporates flexible structuring to meet

budgetary needs

- Low rates resulting from tax-exempt basis

- Offers an alternative financing option without a

voter approval/referendum

- Provides project financing (including soft costs)

- Spreads out the cost of an asset over the useful

life of that asset or project